Sec. 3. Procedures for Certain Corporations. The procedures for the return and return of a corporation's stock shall be as follows:

(a) Corporations and Partnerships.

Get the free 2010 ca ftb form 100

Show details

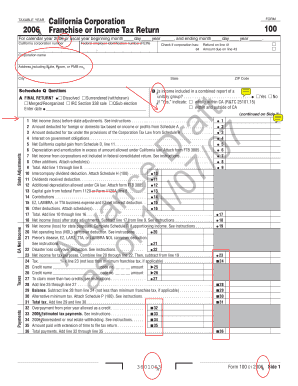

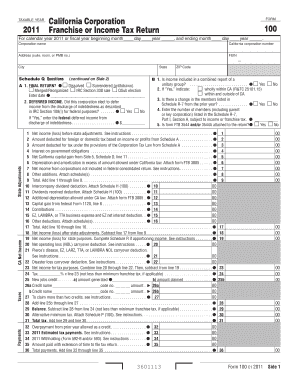

Get 100 Booklet to see the instructions for the 100 Form TAXABLE YEAR 2010 Corporation name California Corporation Franchise or Income Tax Return VEIN State Opcode FORM 100 Californiacorporationnumber

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2010 ca ftb form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2010 ca ftb form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2010 ca ftb form 100 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2010 ca ftb form 100. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Fill form : Try Risk Free

People Also Ask about 2010 ca ftb form 100

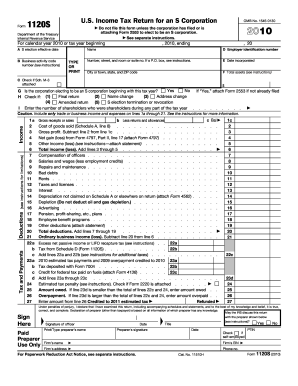

What is the FTB 100S in California?

What is CA FTB Form 100?

Who needs to file CA Form 100?

Does California allow 100% meals deduction?

What is reasonable cause for FTB penalty abatement?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

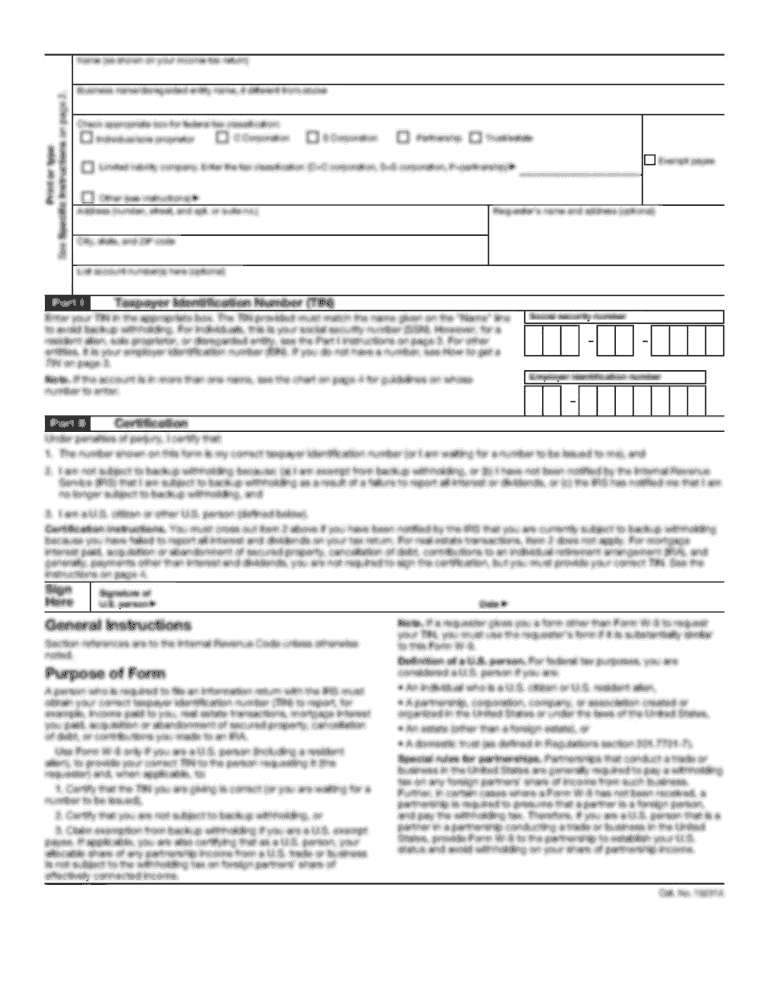

What is ca ftb form 100?

CA FTB Form 100 is the California Corporation Franchise or Income Tax Return form that is used by corporations to report their income and calculate their California franchise or income tax liability.

Who is required to file ca ftb form 100?

All corporations doing business in California, including California domestic corporations, foreign corporations qualified through the California Secretary of State, and corporations doing business in California without proper registration, must file CA FTB Form 100.

How to fill out ca ftb form 100?

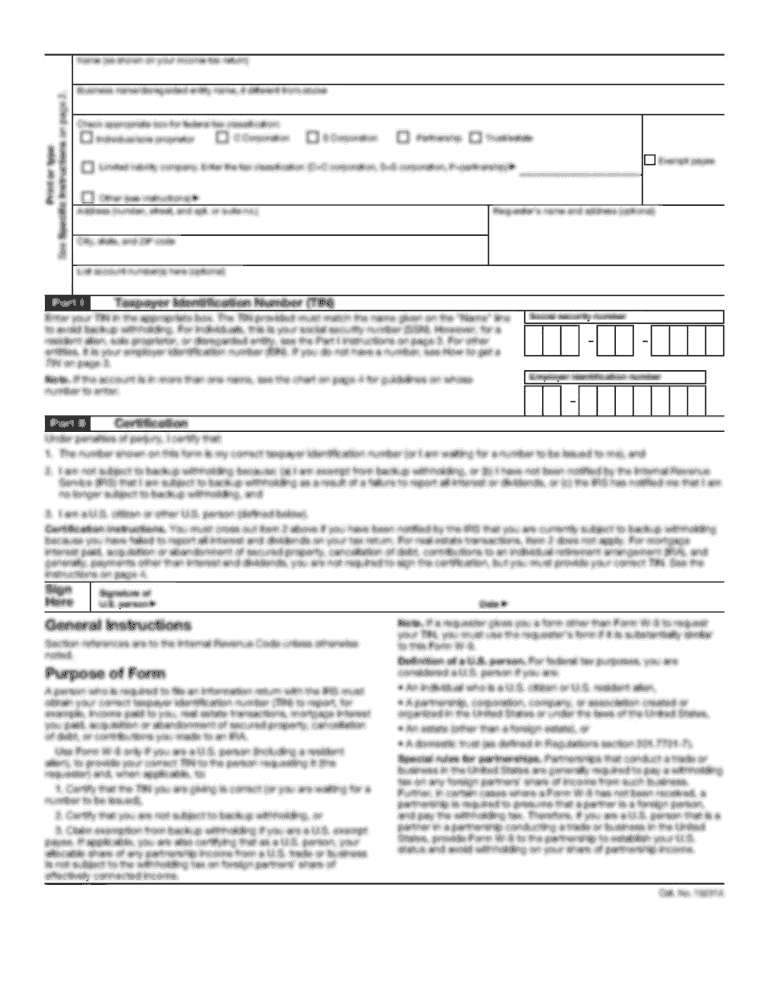

To fill out CA FTB Form 100, you need to provide information such as the corporation's federal employer identification number, business address, details of income and deductions, shareholder information, and other relevant financial data. The form can be completed manually or electronically using tax software approved by the California Franchise Tax Board.

What is the purpose of ca ftb form 100?

The purpose of CA FTB Form 100 is to determine the corporation's tax liability in the state of California and report its income, deductions, and credits for the taxable year.

What information must be reported on ca ftb form 100?

CA FTB Form 100 requires corporations to report their federal taxable income, California source income, deductions, credits, and other relevant financial information. It also requires information about the corporation's ownership and capital stock.

When is the deadline to file ca ftb form 100 in 2023?

The deadline to file CA FTB Form 100 in 2023 is on or before the 15th day of the 4th month following the close of the taxable year. For calendar year corporations, the deadline is generally April 15, 2023.

What is the penalty for the late filing of ca ftb form 100?

The penalty for late filing of CA FTB Form 100 is based on a percentage of the unpaid tax due. The penalty rate is determined by the California Franchise Tax Board and can vary depending on the duration of the delay. It is advisable to file the form on time to avoid any penalties or interest charges.

How can I manage my 2010 ca ftb form 100 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your 2010 ca ftb form 100 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I sign the 2010 ca ftb form 100 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your 2010 ca ftb form 100.

How can I fill out 2010 ca ftb form 100 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your 2010 ca ftb form 100 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your 2010 ca ftb form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.